Establishing successful, long term client relationships

We regard ourselves as one of the leading competitors in the debt collecting industry. We keep abreast of new developments in the collection process and/or law and have refined the process to ensure the best possible result for both our clients and the consumers. The process we follow is transparent, fair, consumer centric and aimed at finding the balance between our client’s needs and the affordability thereof to the consumer. In March 2015 we relocated our call centre to a felicitous premises, enabling us to expand our staff compliment and accommodate large volumes of instructions. Our current capacity is over 60 000 instructions, and growing exponentially. Our call centre ensures a swift and more direct collection method to the benefit of our clients and consumers as it results in reduced legal fees and a more accommodating option for consumers, where affordability is key. Logic and close control measures built into our customized electronic operational system, provides quick and accurate results for our client

Our Goals:

- To establish long term relationships with our clients.

- To deliver service of a high quality.

- To maintain a code of ethics of a high standard.

- To achieve good financial results for our clients.

- To ensure speedy and effective query resolution.

- To make sustainable and affordable payment arrangements with the consumers.

- To give back to our community.

Group Companies:

GVDM Attorneys specialises in debt collecting, through both Legal and Pre-Legal processes, on a commission basis. The practice boasts a contemporary 1000 sq/m call centre specialising in Pre-Legal collections. In February 2008, Legad (Pty) Ltd was introduced into the Group as Franchises, to act as liaison between us and our clients, and to obtain signed consents to emoluments attachment orders. (Section 58’s)

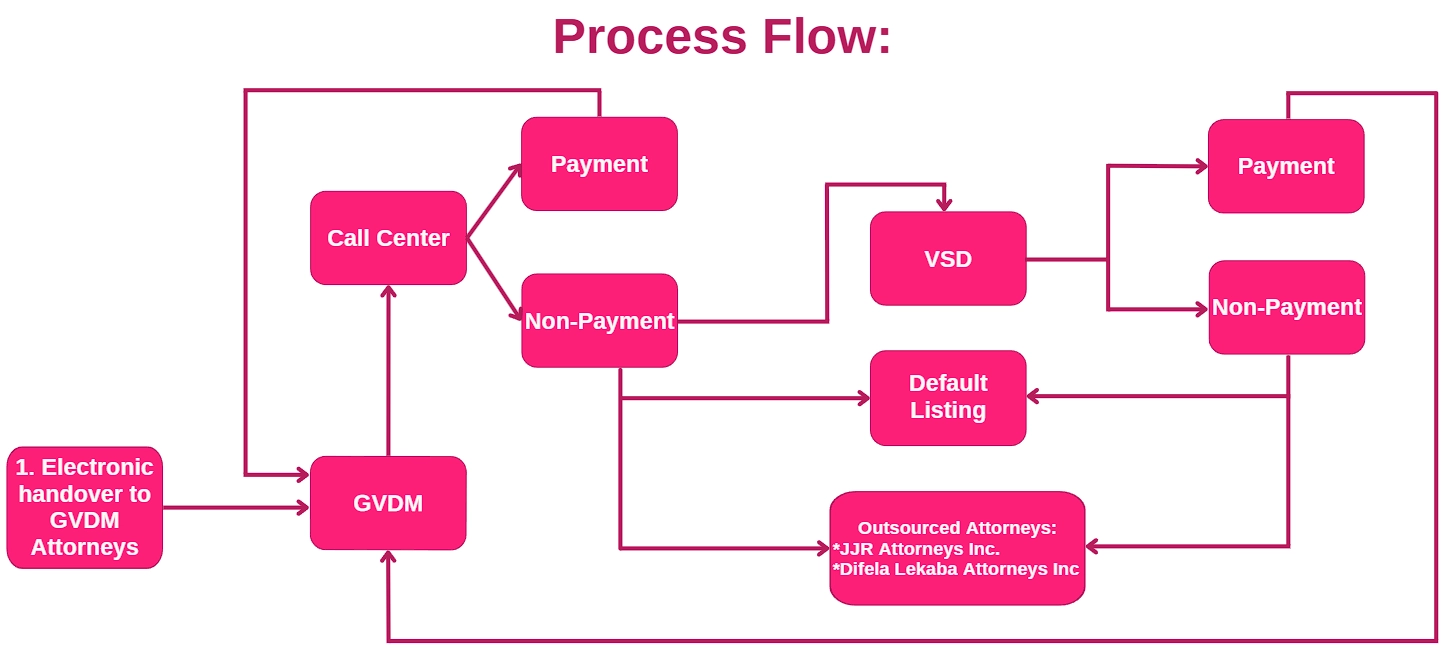

Process

On handover, the client may request that the matters be dealt with in a specific manner:

Call Centre for soft collections only.

Soft collection, then legal action.

Litigation Process.

We provide debt collection services for more than 900 clients on outstanding accounts.

What does soft collection entail?

The consumer is contacted telephonically to invite him/her to make payment arrangements with our offices. This process does not involve any type of legal action and as a result the legal fees to the consumer is much less, making it a faster, friendlier and more affordable collection process. We accept debit order arrangements or “promise to pay” payment arrangements from consumers.

What do we do when we proceed with legal action?

Our hard collections legal process is conducted through both Magistrate and High Court litigation proceedings. At every stage, our office strives to resolve matters with the objective of settling accounts efficiently and ethically, prioritizing our clients’ best interests while upholding and respecting the rights of the consumers involved.